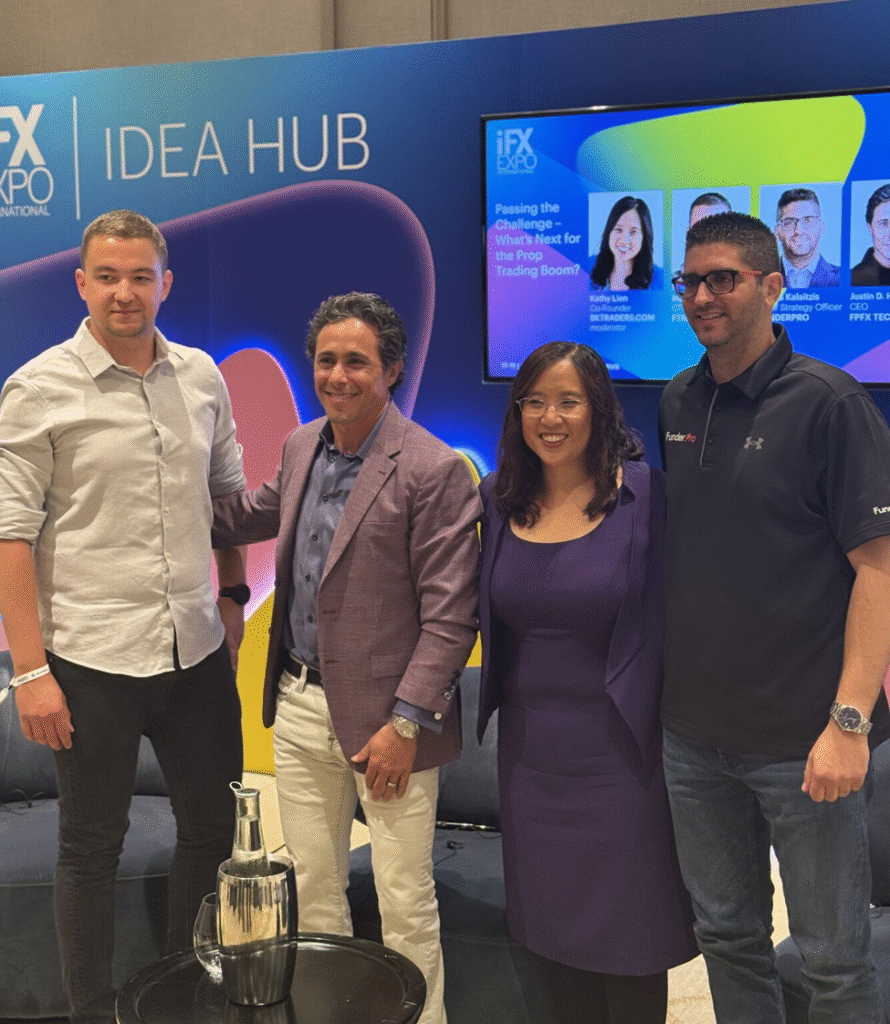

Passing the Challenge – What’s Next for the Prop Trading Boom?

At iFX EXPO 2025, top leaders tackled the future of funded trading and what comes after the challenge.

The prop trading model may have exploded thanks to the popularity of “funded challenges,” but at iFX EXPO 2025, one panel looked past the pass-or-fail metrics and asked a deeper question: Where does the industry go from here?

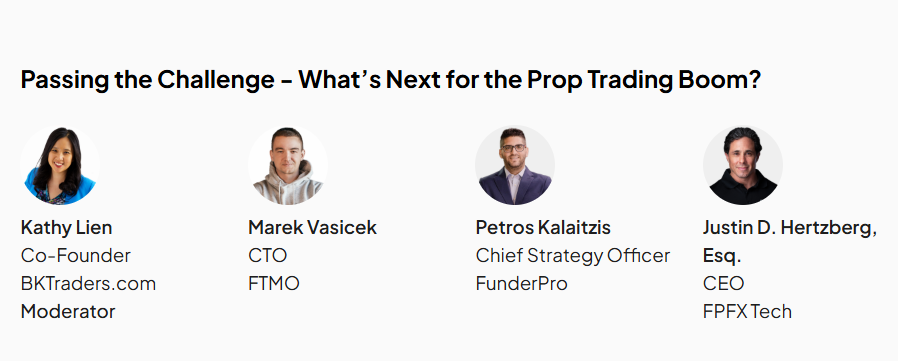

Moderated by veteran trader and author Kathy Lien, the session “Passing the Challenge – What’s Next for the Prop Trading Boom?” brought together key players from across the ecosystem, including Marek Vasicek (CTO, FTMO), Petros Kalaitzis (CSO, FunderPro), and Justin Hertzberg (CEO, FPFX Tech).

We asked Petros Kalaitzis to share the key highlights from the panel:

The Prop Boom Isn’t Slowing Down – But It’s Evolving Fast

“Tech innovation is a key driver-firms credit their success to scalable infrastructure and smarter platforms,” Kalaitzis noted.

From custom dashboards to real-time risk metrics and advanced automation, leading firms are investing heavily to meet the demands of modern traders.

Hybrid Models & Smarter Traders

Prop trading is no longer just about challenges and payouts.

“Hybrid models blending brokerage and prop arms are gaining momentum,” he said.

At the same time, the trader base is becoming more mature and demanding.

“Traders are pushing firms to upgrade automation, execution, and risk controls.”

Risk Tech is Not Optional Anymore

“Strong risk management and automation tools are now essential,” Kalaitzis emphasized,

especially as some traders attempt to exploit challenge systems. The goal is to strike a balance between offering opportunity and maintaining system integrity.

Regulation is Coming – But It’s Murky

While traditional brokerages face well-defined rules, the path for prop firms remains unclear.

“Since prop firms don’t hold client funds, traditional regulatory logic doesn’t neatly apply,” Kalaitzis explained.

Still, every panel touched on the topic – and the consensus is that some form of regulation is inevitable.

Final Takeaway

Prop trading isn’t slowing down – it’s maturing. Firms that want to survive this next wave will need to evolve fast, invest in infrastructure, and meet the new expectations of a sharper, more professional trader base. The challenge may be over, but the real work has just begun.